Did you know that a typical trade transaction involves up to 27 documents and can take up to 2-3 months to process?

Despite the digital nature of LC processes managed on SWIFT, document presentation still relies on physical couriering. This frustrating physical presentation is a significant bottleneck in global trade, hindering growth, innovation and low LC adoption rates. At one point, efficiency in trade finance operations was simply advantageous for growth. Now, it’s essential in order for businesses to thrive.

In this post, we’ll compare the traditional paper-based letter of credit presentation process with WaveBL’s digital approach. Plus, we’ll discuss why trade finance efficiency matters and how WaveBL addresses the reliance on physical bank presentations in the traditional system.

Understanding Traditional Global Trade Finance

A letter of credit transaction is a financial instrument commonly used in global trade to mitigate risk for both buyers and sellers. Essentially, it involves a bank guaranteeing payment to the seller on behalf of the buyer. This arrangement provides security and trust in international trade by ensuring that payment is made only when the seller fulfills their obligations and provides the necessary documentation.

However, the traditional paper bank presentation process. Vital to managing letters of credit, can be difficult and prone to delays and errors, discouraging businesses and banks from participating in the financing of cross jurisdiction trade transactions. The need to accept eBL transformative solutions in trade finance operations is evident, and this is where digital solutions like WaveBL come into play.

Previously, without electronic bills of lading, achieving a structured bank presentation digitally was impossible. Now, with our secure technology, we’ve made this concept a reality.

To grasp the complexities of modern trade finance, let’s break down the traditional steps involved in a letter of credit transaction.

Steps of a Letter of Credit Transaction

Step One: Issuance of Letter of Credit

To initiate a letter of credit transaction, the importer (Applicant) and exporter (Beneficiary) would typically come to terms evidenced by a Proforma Invoice. Upon approval, the Issuing bank issues the letter of credit to the advising bank, guaranteeing payment for the seller, contingent on document presentation. This process is initiated on SWIFT but involves coordination between banks and customers, potentially leading to delays.

Step Two: Document Preparation and Presentation to Advising Bank

With the letter of credit in place, the seller proceeds with document preparation, including the bill of lading, commercial invoice, and packing list, all presented to the Advising Bank, which will scrutinize the documents to confirm they comply with the LC requirements. The preparation and shipment process may vary depending on the nature of the goods and shipping logistics, typically taking several days to weeks.

Step Three: Document Presentation for Bank Reviewal

Upon receipt of the documents, the advising bank meticulously scrutinizes them to ensure compliance with the terms outlined in the letter of credit. This critical review process aims to verify the authenticity and accuracy of the documents provided by the exporter. However, this stage often proves to be time-consuming and cumbersome due to various challenges associated with physical document handling.

In many cases, documents need to be sent multiple times, as inconsistencies, missing documents, or even forgery (which is impossible with digital documents) may arise. This repetitive process results in significant time and money losses, as courier services are required for each document submission.

Moreover, the reliance on physical documents introduces the risk of human error and delays. Even the smallest discrepancy can lead to additional rounds of document submissions, further prolonging the review process.

Step Four: Presentation to Issuing Bank, Payment and Document Release

Upon receipt of the documents, the issuing bank meticulously reviews them to ensure compliance with the letter of credit terms. If satisfied, the bank releases payment to the advising bank, facilitating the transfer of funds to the exporter. However, the reliance on paper-based presentations poses challenges.

Since the importer doesn’t review the documents initially, there’s a heightened risk of miscommunication and errors. Banks bear liability for any inaccuracies until this point, underscoring the importance of transitioning to digital solutions to streamline the process and reduce errors. Now that we’ve outlined the traditional process let’s explore how WaveBL’s digital solutions transform each step for enhanced efficiency and accuracy.

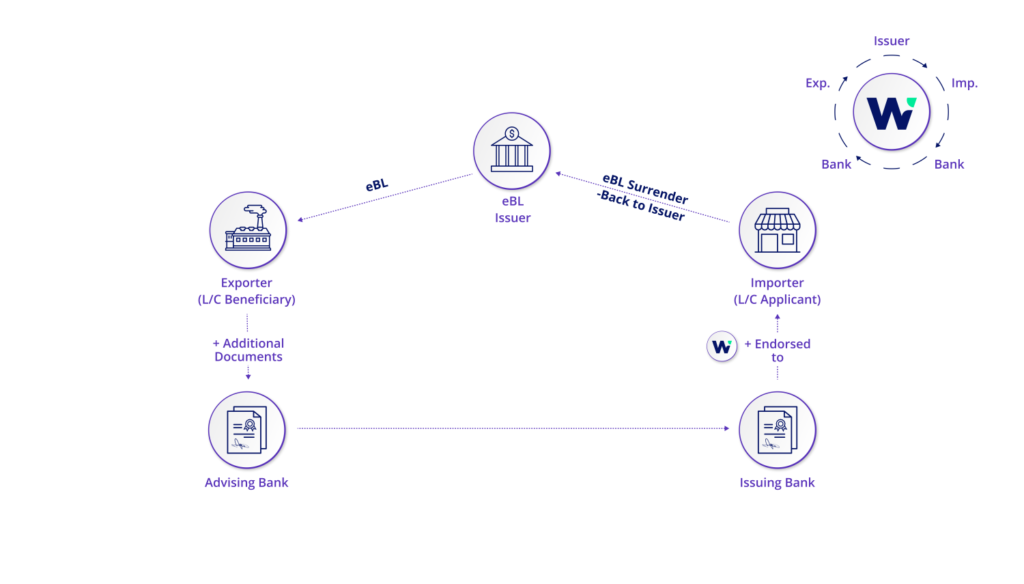

From eBL to Electronic Structured Bank Presentation

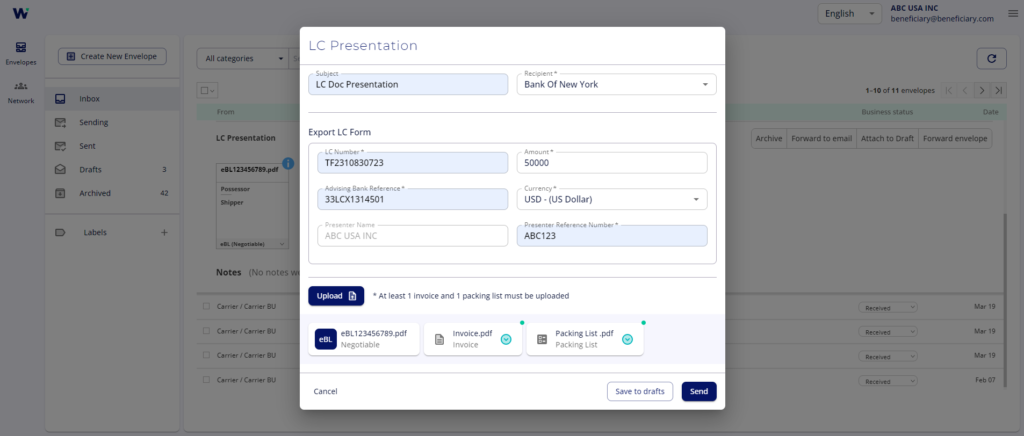

At WaveBL, we specialize in streamlining trade finance processes by offering a seamless collaboration platform for banks, shipping parties, and businesses. Through WaveBL, users can easily exchange electronic Bills of Lading (eBLs) and other trade documents, eliminating the need for risky and frustrating paper-based processes.

Our platform enables real-time communication and document exchange, enhancing visibility throughout the entire shipping journey. By digitizing trade documents, WaveBL ensures compliance with regulatory requirements while significantly reducing the time and resources needed for trade finance operations.

Benefits of WaveBL’s Structured Bank Presentation

-

Gain Access to the fastest-growing Electronic Bill of Lading platform

-

Receive possession of the eBL alongside all other documentary requirements in a structured authenticable bank presentation envelope

-

Slash the physical document handling for LoC and Collection services

- Easily integrated into trade finance banking software

- Create exportable, verifiable proof of presentation for external use

- Receive certified proof of presentation for transparency and accountability

Trusted Partner for Trade Finance

-

Temenos Exchange: Provides financial institutions with instant access to our secure electronic trade document platform. This integration enables banks to seamlessly manage and process electronic bills of lading, through Temenos T24 software, facilitating smoother trade finance operations.

-

Surecomp RIVO: Offers a platform where banks and customers can communicate and exchange documents, not including eBLs.

Join the Global Trade Finance Digitizing Revolution: Work Smarter with WaveBL

From eliminating paperwork bottlenecks to ensuring compliance and enhancing visibility, WaveBL offers innovative solutions to redefine trade finance for the digital age.

As Swift rightly puts it, “Electronic documents have the potential to make global trade more efficient, cheaper, and more secure.”

With WaveBL’s innovative solutions, businesses can embrace the future of global trade and experience unprecedented efficiency, accuracy, and competitiveness.

Stay tuned for more insights, success stories, and updates as we navigate the future of trade together.

WaveBL – Transforming Trade, Empowering Businesses. Your Gateway to Efficient Trade